How Biometrics Can Help Improve Banking Experiences?

The issue of money laundering, fraudulent transactions, and financial terrorism has been weighing down the banking system in recent years. Finding ways to tighten security to ensure customer identity and banking information can be secured and protected has become essential. However, pins, passwords, security questions, and cards, etc. can prove to be quite cumbersome. Many customers, especially those who are senior citizens, tend to forget complicated passwords or numbers containing 8-16 digits. Cards can be lost or stolen and answers to security questions take time to be recalled in telephonic conversations.

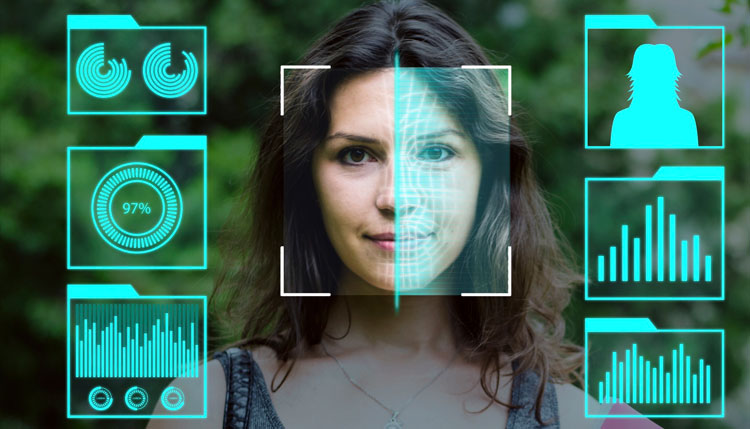

The integration of biometric technology in banking seems to be the answer. Biometric solutions use distinguishing human physical characteristics like facial recognition and iris recognition through scans. Besides physical characters, behavioral characteristics included in voice cadence and tone, signatures, and keystrokes are also included in biometric identification solutions.

Advantages of Using Biometric Technology Solutions in the Banking Sector

Protection of Banking Information:

The use of biometric technology offers some of the most stringent methods of authentication of clients and customers. This ensures that no banking information is compromised or accessed by any unauthorized person.

Accuracy and Time Effectiveness:

In an age where time is equal to money, speed is essential. It is, therefore, no surprise that customers want to be served quickly without the hassle or long drawn authentication procedures. Using biometrics enables quick and efficient customer identification. With a fast scan, customers can be identified correctly and promptly.

Reduction of Insider Fraud:

Using biometric technology to establish employee authentication can go a long mile in protecting customers against insider fraud.

Online Banking Security:

Identity theft and cybercrime have risen significantly in the last few years, especially in the banking sector. Using biometrics in online banking can protect customers against identity theft and fraudulent transactions.

Biometrics in ATMs:

ATMs with biometric technology can make life easier for both customers and banks. For customers, biometrics can provide the flexibility of transactions even without banking cards. For banks, it means that they can avoid the liabilities and costs associated with stolen or lost cards.

Improved Customer Care Service Experience:

For telephonic or online customer care services, biometric technology can do wonders. The need for tighter security and a frictionless experience can be met with voice recognition technology and other biometric solutions like keystroke recognition.

Banking systems around the world are beginning to integrate biometric technology solutions. The results include enhanced customer experience with minimized risk of fraudulent transactions, identity theft, and breach of banking information. For more information please write to info@trueid.in or visit www.trueid.in